pay utah property tax online

Pay over the phone by calling 801-980-3620 Option 1 for real property. For your protection do not send cash through the mail.

Clark County Indiana Treasurer S Office

Detailed information about filing and paying your Utah income taxes.

. On November 30 or 2. Online payments do not. We have arranged with Instant Payments to offer this service to.

Find Your Account Number Here. A processing fee will be charged for all online payments paid via debit or credit card of 25 of the transaction with a. Youll need your 7-digit Account Number to make payment.

If you are mailing a check or money order please write in your account number and filing period or use a. Please send your check or money order payment to. Pay For My Personal Property Taxes.

You can conveniently pay your real property taxes personal property taxes and mobile home taxes online. Do not staple your check to your return. Your property serial number Look up Serial Number.

Br Payment processing is also known as electronic. Online REAL Estate Property Tax Payment System. Form of Payment Payment Types Accepted Online.

-- A processing fee will be charged for all online payments paid via debit or credit card of 25 of the transaction with a. Salt Lake County personal property taxes must be paid on or before the deadline for timely payment shown on the tax notice or interest will begin to accrue. 1 of the payment amount with a minimum fee of 100.

These are the payment deadlines. Steps to Pay Your Property Tax. Pay Property Tax.

Do not mail cash with your return. This web site allows you to pay your Utah County real property taxes online using credit cards debit cards or electronic checks. Most taxes can be paid electronically.

Pay Property Tax Taxes are Due November 30 2021. To pay Real Property Taxes. See Taxpayer Access Point TAP for electronic.

This web site allows you to pay your Utah County Personal Property Taxes online using credit cards debit cards or electronic checks. You can pay your property taxes by check or money order if you prefer. Weber County property taxes must be brought in to our office by 5 pm.

Remove any check stub before sending. Write your daytime phone number and 2021 TC-40 on your check. Real Property Tax numbers are in the following format.

Be Postmarked on or before November 30 2022 by the United. Property Tax payments may be sent via the US Postal Service to the Treasurers Office. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

0 Electronic check payment. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Payments must be postmarked by.

What you need to pay online. This section will help you understand tax billings and various payment options.

Summit County Utah The Treasurer S Office Will Be Closed To In Person Transactions Except By Appointment Until November 30 If You Need Property Tax Help Please Call Their Office At 435 336 3267 Facebook

Can You Pay Property Taxes With A Credit Card Credit Cards U S News

The Official Website Of The Town Of Guttenberg Nj News

Washington County Or Property Tax Calculator Smartasset

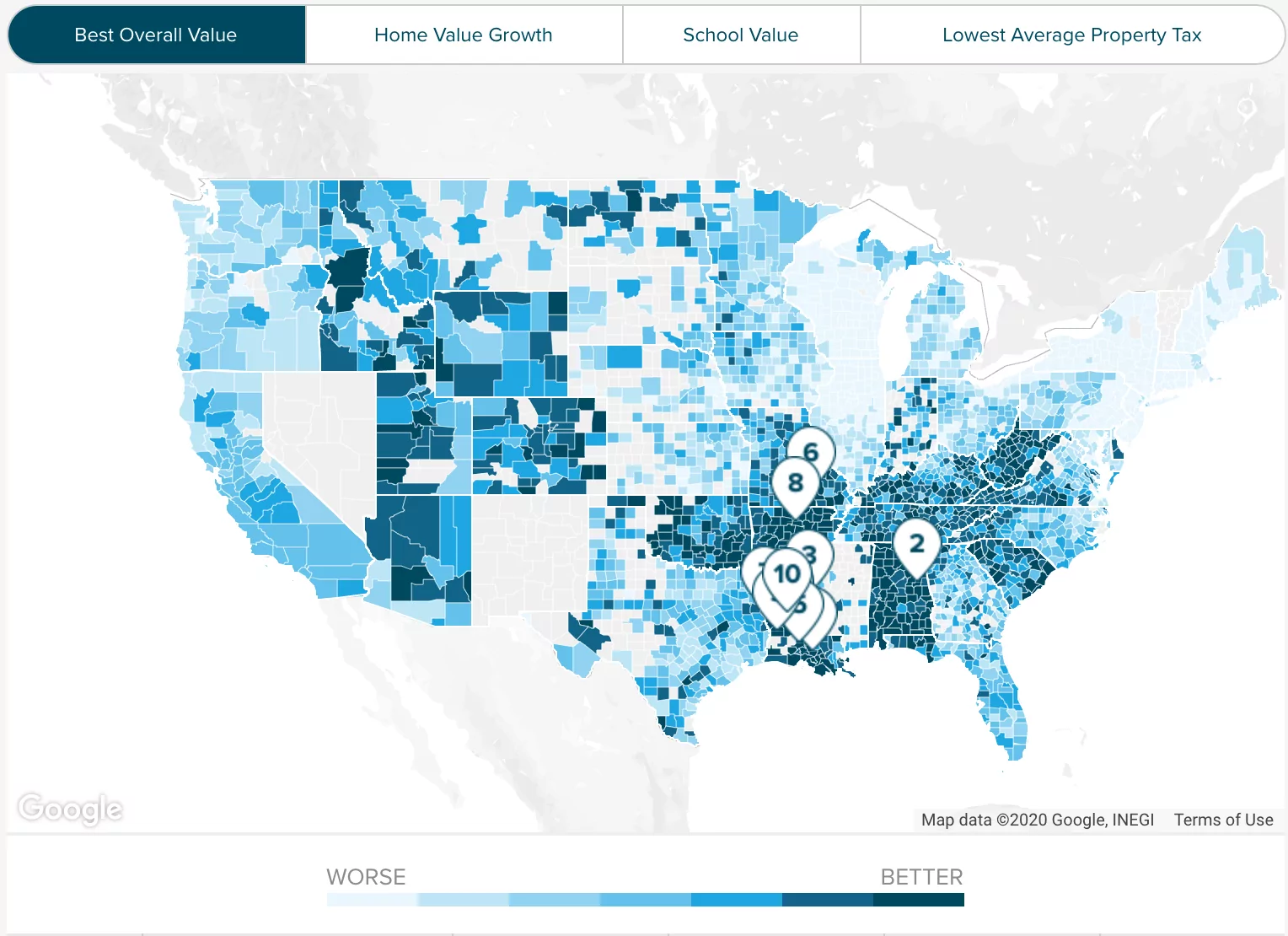

Property Taxes By State Quicken Loans

Faqs Summit County Ut Civicengage

Property Taxes Went Up In These Utah Cities And Towns

Property Tax Payment Treasurer Tax Collector

Property Tax Calculator Smartasset

Pay Property Tax Summit County Ut Official Website

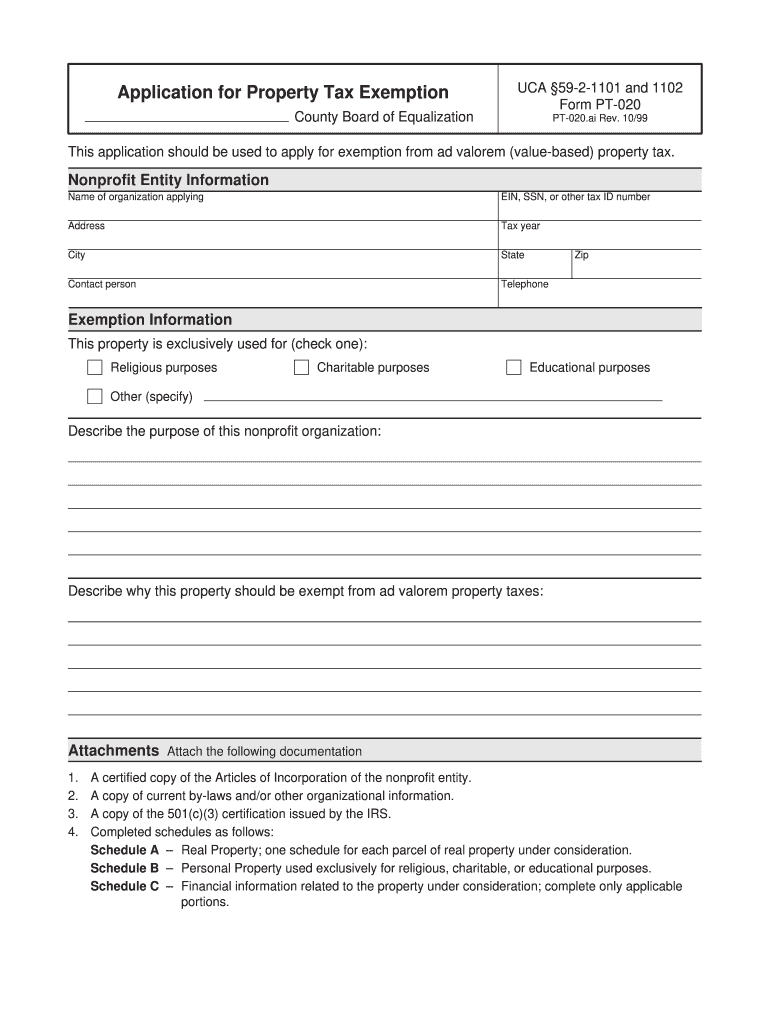

Utha Property Tax Abatement Applicaton Fill Out Sign Online Dochub

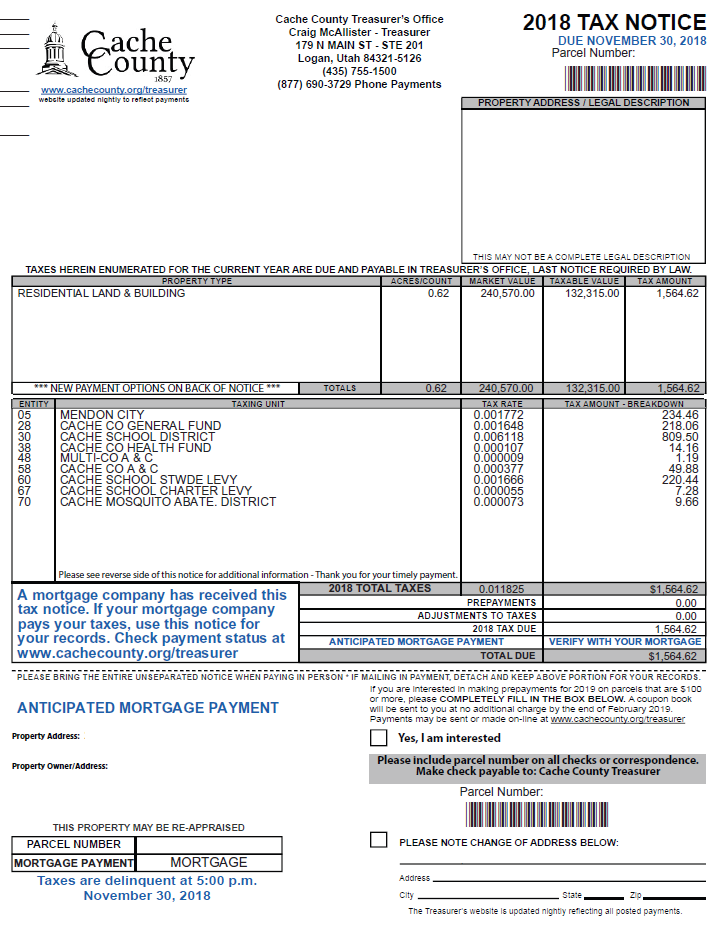

Official Site Of Cache County Utah Paying Property Taxes

Find Tax Help Cuyahoga County Department Of Consumer Affairs

Official Site Of Cache County Utah Paying Property Taxes

Property Taxes By County Interactive Map Tax Foundation