stock option exercise tax calculator

Ad Powerful intuitive trading platforms help you to trade smarter not harder. Ad Exercise your options early with Equitybee - funding covers all expenses including tax.

Tax Planning For Stock Options

This is ordinary wage.

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

. Enter the number of stock options you have granted to you. Ad Start Your Investing Education. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share.

For every 1 beyond the phase out amount the exemption amount is reduced by 025. How much are your stock options worth. Exercise incentive stock options without paying the alternative minimum tax.

To estimate your exercise tax bill and determine if you need to make additional payments. This calculator illustrates the tax benefits of exercising your stock options before IPO. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your.

Keep Your Finger on All Your Investments at All Time With Real Time Alerts on Your Options. It requires data such as. Lets say you got a grant price of 20 per share but when you exercise your.

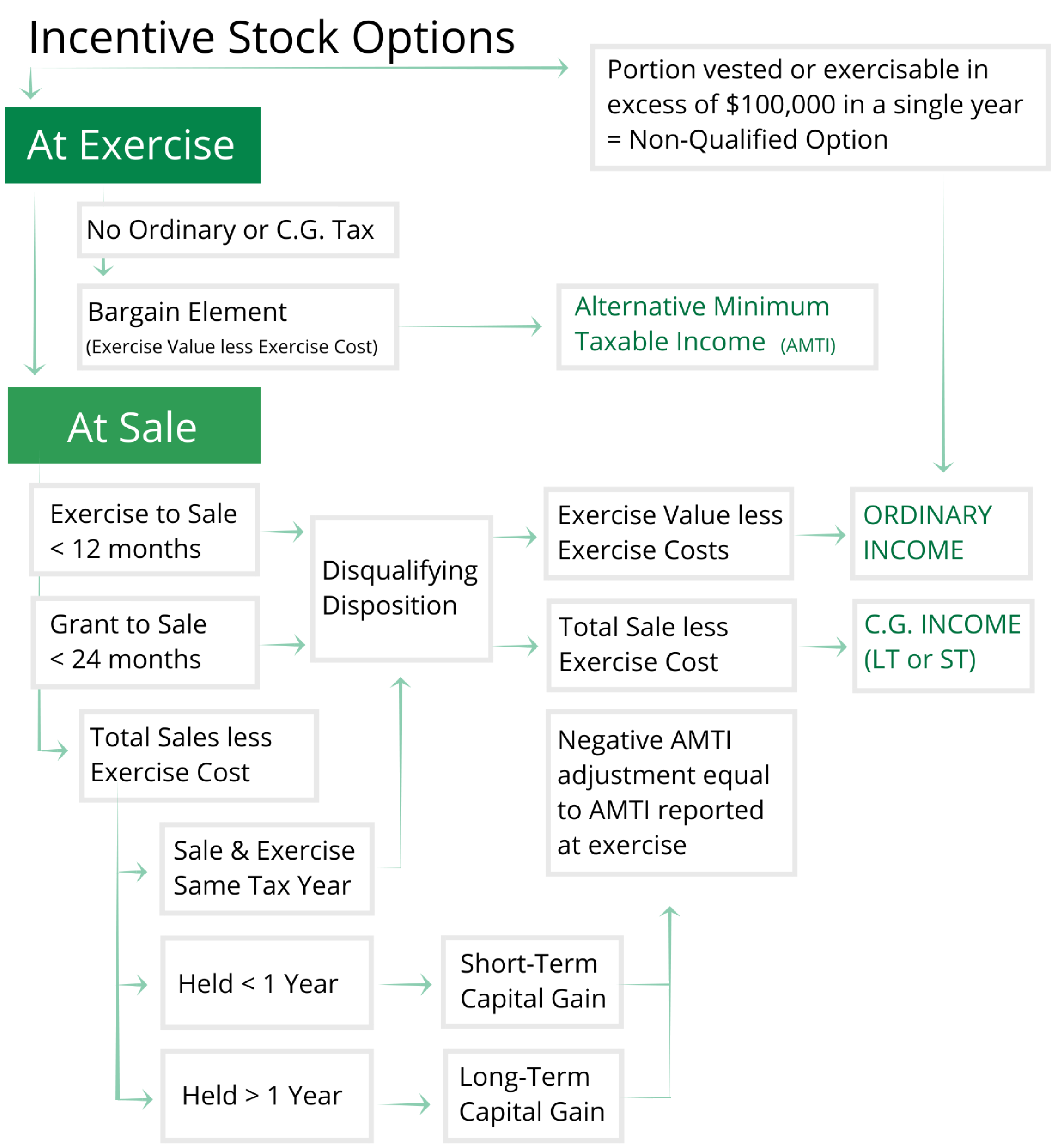

Ad Fidelity Will Help You Manage Your Equity Company Plan For The Future You Desire. The Stock Option Plan specifies the total number of shares in the option pool. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022.

Please enter your option information below to see your potential savings. Calculate the costs to exercise your stock options - including taxes. You will only need to pay the greater of.

Get side-by-side comparisons of different plans for your equity in 10 minutes or less. Enter the number of years you would like to forecast the ESOs future value. Type of Option ISONSO.

NSO Tax Occasion 1 - At Exercise. Your Equity Administration Deserves Industry-Leading Strategies from Fidelity. Your stock options cost 1000 100 share options x 10 grant price.

Exercising your non-qualified stock options triggers a tax. On this page is an Incentive Stock Options or ISO calculator. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market.

Exercise incentive stock options. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. Exercising stock options and taxes.

You pay the stock. Our Stock Option Tax Calculator automatically accounts for it. On this page is a non-qualified stock option or NSO calculator.

A non-qualified stock option NSO tax calculator estimates your gain in a hypothetical exercise scenario and computes the associated costs. The rest of the numbers are the same as before. Calculate the costs to exercise your stock options - including taxes.

Equitybees funding solution covers all exercise costs including associated taxes. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Then can get as much as 10x higher than the strike price you pay to actually. This permalink creates a unique url for this online calculator with your saved information. Exercise tax bills can become pretty extreme.

Customizable Real Time Market Alerts. When you exercise the option you include in income the fair market value of the stock at the time you acquired it less any amount you paid for the stock. For example a single person who has AMTI of 525000 will only have 72900 - 525000 -.

Real-time quotes and premium tools to help you with enhancing your trading experience. Say in total you have 15000 ISOs. Heres a real-life example.

Learn Stocks Bonds Futures More. Purchase your shares of. Enter the strike price per share.

The tax implications of exercising stock options. Lets explore what it means to exercise stock options the taxes you may need to pay and the common times people exercise their options. Click to follow the link and save it to your Favorites so.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Stock Option Tax Calculator. The stock price is 50.

When your stock options vest on January 1 you decide to exercise your shares. When logging into your stock option portal you should have four options to choose from with your 100 stock options. Ad Dont Miss Key Headlines With Stock News Alerts.

Use the Stock Option Tax Calculator to calculate your estimated tax bill. Ad Exercise your options early with Equitybee - funding covers all expenses including tax. Taxes for Non-Qualified Stock Options.

Equitybees funding solution covers all exercise costs including associated taxes.

Stock Options 101 The Essentials Mystockoptions Com

Video Included What Is An Employee Stock Option Mystockoptions Com

Employee Stock Options Financial Edge

Secfi Decide When To Exercise Your Stock Options

Net Exercising Your Stock Options

How Stock Options Are Taxed Carta

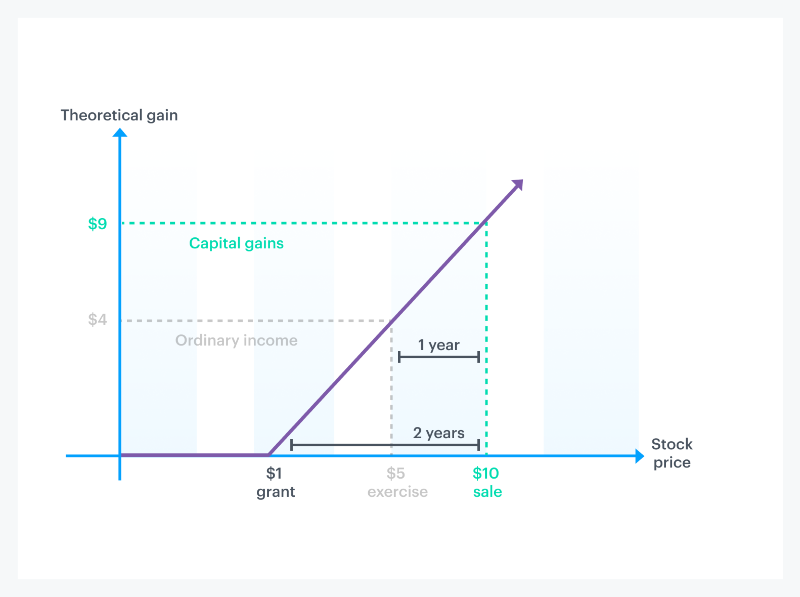

What Are The Holding Period Requirements Of An Iso Mystockoptions Com

How Much Are My Options Worth Eso Fund

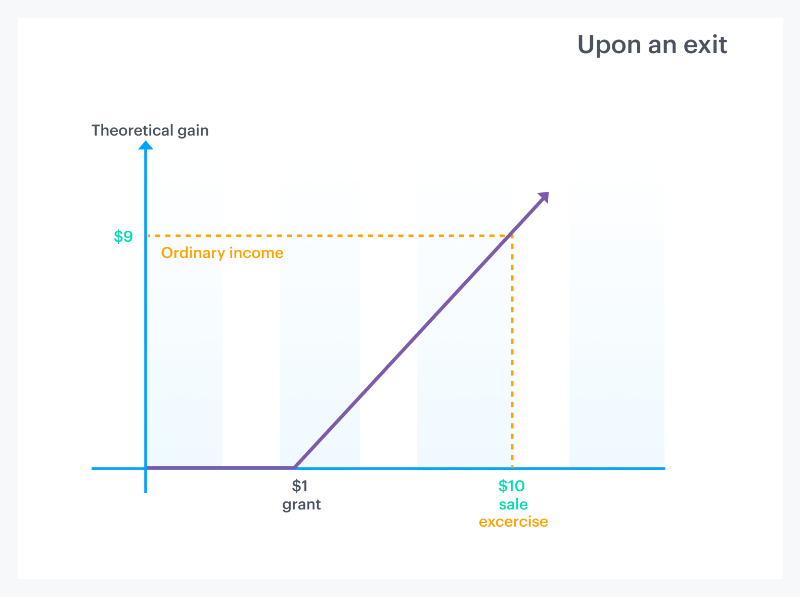

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen